Cash Flow Banking Whole Life Insurance

7 steps to creating your own private banking system. You can borrow money from your life insurance company using your whole life cash value as collateral.

Whole Life Insurance What You Need To Know White Coat Investor

Why Whole Life Is a Potent Savings Tool.

Cash flow banking whole life insurance. It also increases the amount of Paid-Up Additions you can buy in the early years which is like the turbocharger that will greatly accelerate growth inside the whole life policy to be your own bank. You can also check out our resources for more. With this method you can borrow against the cash value of your life insurance policy.

If you are practicing infinite banking you are using your whole life insurance as an asset to borrow against for the purchase of other assets. Normally when you take out a loan from the bank or another financial institution you are. In this video Hutch shows you how to use Whole Life or even IUL as the hub for the ultimate cash flow management system.

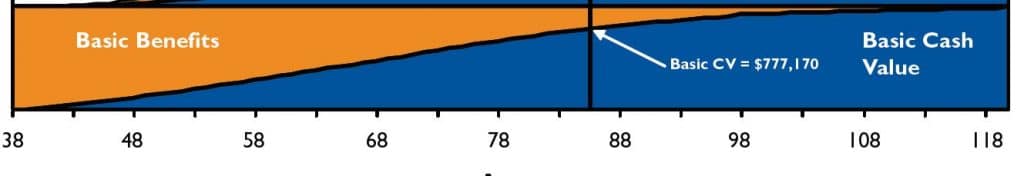

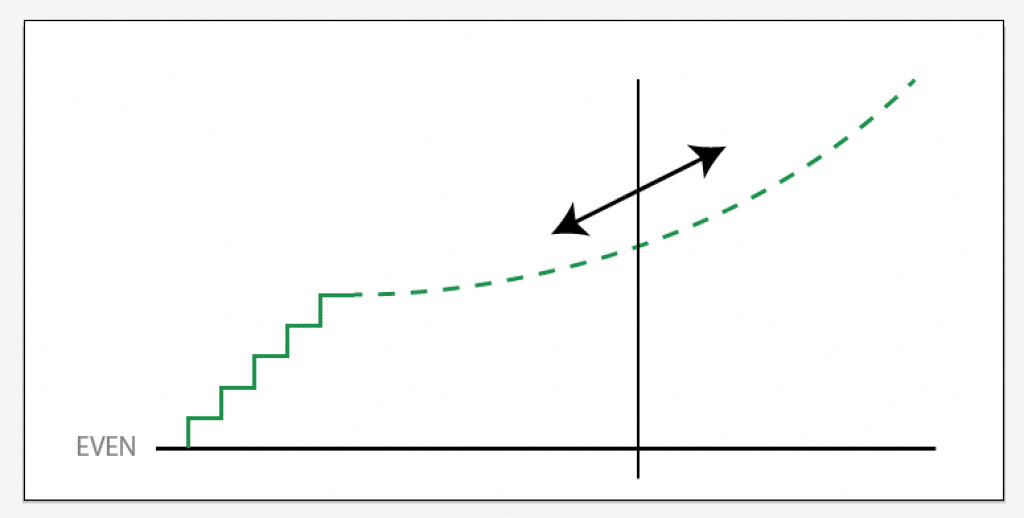

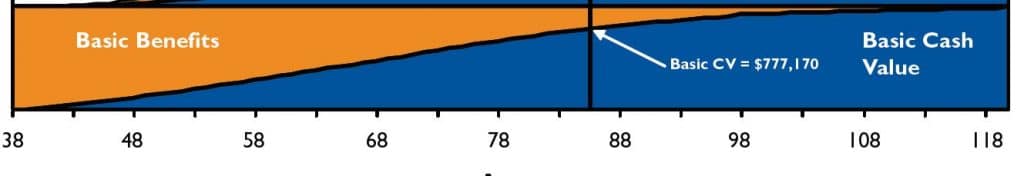

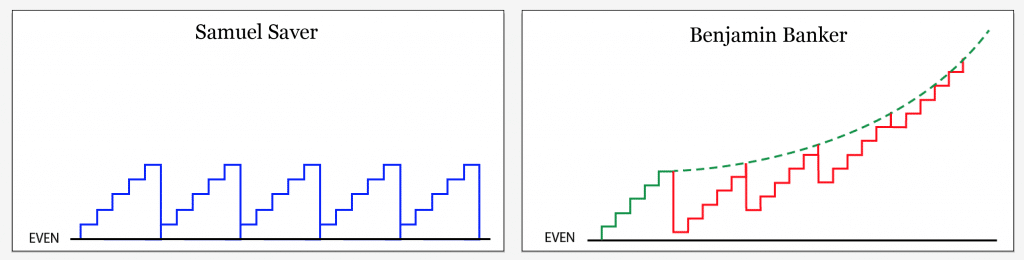

Once You Have More Cash Value Than the Total Premiums Youve Paid Theres No More Cost to You. As youve discovered by now Cash Flow Banking is a strategy to overfund a whole life insurance policy and use the cash value of the policy as your own personal Bank When you set up a whole life insurance policy correctly it gives you an incredible amount of protection and guaranteed growth while providing cash flow liquidity. Without a substantial cash pool the banking options are seriously limited.

1727 - Garrett explains the how you benefit from the tax preferred treatment of permanent life insurance through the FIFO rule and your ability to borrow against your cash value. 1545 - Garrett shows how you can use Cash Flow Banking to thrive in times of high-inflation. You do need Whole Life but by blending it with this additional term rider you can substantially bring down the cost of the total death benefit needed to support the amount of cash you want to pump into your bank.

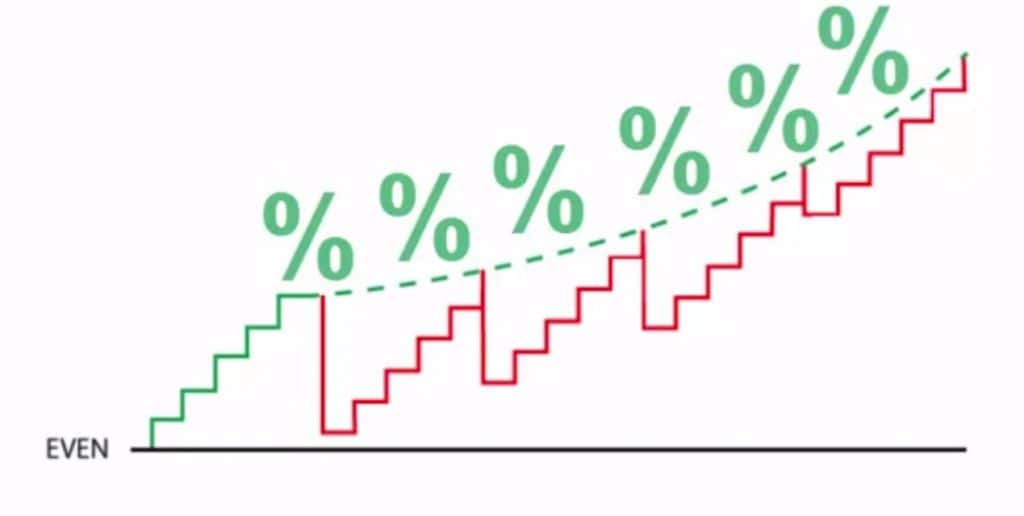

Cash flow banking is leveraging cash value in a whole life insurance policy to self-finance make purchases make investments or to create free cash flow. With 6 compounding loan interest the policy would lapse within nine years as the loan compounds to 50684 eroding the net equity down to 0. Cash Value Life Insurance.

Cash flow banking means you can use a whole life insurance policy to finance expenses for investments. For example imagine a situation where a life insurance policyowner has a whole life policy with a 50000 cash value and takes out a 30000 loan at a 6 interest rate which means the policy has a net equity value of 20000. As you are doing this you are engaging in diversification by purchasing cash flowing assets.

So this one is just saying hey if you had 100000 savings you liquidated 95000 to go invest buying a single family home and a duplex the cash flows 1070 a month net right versus having 100000 your life insurance borrowing the 95000 for the insurance company so your full hundred thousand is still making money and youre also taking the cash flow and taking it to your pay down your line of credit. The best whole life insurance policy for infinite banking is one that uses the most optimal design for the accumulation of cash value. Whole life cash value growth is essential to the Infinite Banking Concept because the cash value is the pool of money that provides the funding for all your banking needs.

This eye-opening video helps you overcome those inner-biases so you can create meaningful compounding with what were previously dead assets to you. Today Im going to walk through this as well as guide you on some other important factors concerning any plans you might have to purchase a whole life insurance policy to implement any of the self banking strategies. Cash flow banking is a way of creating your own bank.

Cash flow banking can provide you access to capital without having to go through the traditional loan process at a bank. Walt Disney and Ray Kroc used their whole life insurance policies to. Benefits of Cash Flow Banking.

In most UL policies even if the premium is finally paid once it is late the insurance company is off the hook for supporting any guaranteed premiums cash value amounts or. Some of the main advantages of cash flow banking are. As always we emphasize that the dividends are NOT guaranteed and this fact is trumpeted often by the critics of whole.

For those of you who learn better through video we offer the following two webinars. Clients often get excited enough to take out a life insurance policy designed for banking but then neglect to use it. Where Whole Life Insurance Fits in the Cash Flow System.

It is most often utilized with whole life insurance or another type of permanent life insurance policy. Thus you are retaining the interest within the cash value of your own life insurance policy rather than paying off the bank. The claim is that rather than enriching the bank your payments go.

High Cash Value Whole Life Insurance Isnt a Cost or an Expense Its a Savings Plan. Whole Life Insurance Values Are Net of Taxes Fees and Costs. What Is Cash Flow Banking.

Life Insurance Policy Loans Tax Rules And Risks

The Top 4 Myths Behind Being Your Own Banker Banking Truths

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Borrowing Against Life Insurance Why It Pays To Become Your Own Banker

How To Evaluate Your Own Whole Life Policy

Top 10 Pros And Cons Of The Infinite Banking Concept 2021 Edition How To Become Your Own Banker With Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Private Family Banking System With Whole Life Insurance Paradigm Life

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Cash Flow Banking With Whole Life Insurance Explained

Life Insurance Loans A Risky Way To Bank On Yourself

Cash Flow Banking With Whole Life Insurance Explained

Using Life Insurance As Your Own Bank 7 Steps

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Using Life Insurance As Your Own Bank 7 Steps

Life Insurance Loans A Risky Way To Bank On Yourself

12 Questions To Ask About Whole Life Insurance Policies White Coat Investor

Using Life Insurance As Your Own Bank 7 Steps

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Post a Comment for "Cash Flow Banking Whole Life Insurance"