Cumulative Cash Flow Formula Excel

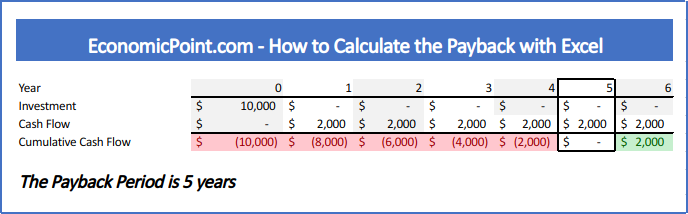

The cumulative cash surplus at the end of March is used as the beginning cash balance for April when you are compiling a projected monthly cash balance report. PP Initial Investment Cash Flow For example if you invested 10000 in a business that gives you 2000 per year the payback period is 10000 2000 5.

The logic is the same as technique 1 above using SUMIF to add all cash flows in a given quarter.

Cumulative cash flow formula excel. Enter all the investments required. The resulting value will be the quarter for a given month. XNPVdiscount rate series of all cash flows dates of all cash flows With XNPV its possible to discount cash flows.

Most capital investment projects begin with a large negative cash flow the up-front investment followed by a sequence of positive cash flows and therefore have a unique IRR. Advertentie Met debiteurensoftware voor realtime overzicht en controle over dso en cashflow. Discounted Cash Flow DCF Formula.

Now I need to find the monthly cash flow per the s-curve or distribution curve. Now you can copy the formula to as many cells as you want and the formula cells will look empty until you enter a number in the corresponding row in column C. Looking for more details on Operating Cash Flow formula.

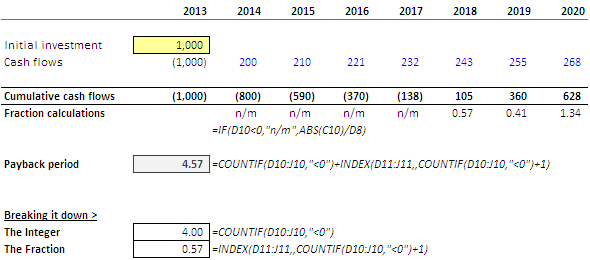

I need a formula for doing cash flow projection. Same cash flow every year When the cash flow remains constant every year after the initial investment the payback period can be calculated using the following formula. Create a basic cash flow forecast using excel.

Enter all the cash flows. Cumulative cash flow is calculated by adding all of the cash flows from the inception of a company or project. I need some help whats the formula for the cumulative cash flow on excel so that each month they add and become cumulative on excel.

Follow these steps to calculate the payback in Excel. The IF formula allows you to change the outcome of your Excel calculation depending on the assumption used in a given period. 85000 0 9000 -10000 66000 That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities.

There are just a few most useful Excel formulas needed to create a cash flow forecast. Calculate cumulative cash flows CCC for each year and enter the result in the Year X columnCumulative Cash Flows row. The cumulative cash surplus shown on a cash budget is equal to the ending cash balance plus the minimum cash balance retained by the firm.

The formula instructs Excel to do the following. Can someone please guide me how to do this. If cell C2 is blank then return an empty string blank cell otherwise apply the cumulative total formula.

What does Cumulative Cash Flow mean. The total Discounted Cash Flow DCF of an investment is also referred to as the Net Present Value NPV NPV Formula A guide to the NPV formula in Excel when performing financial analysisIts important to understand exactly how the NPV formula works in Excel and the math behind it. Advertentie Met debiteurensoftware voor realtime overzicht en controle over dso en cashflow.

I have the s-curve Cumulative Time vs Cumulative Cost. If you know SUM IF SUMIFS and COUNTIFS formulas you are ready to create an effective financial model. Discounted Cash Flow DCF Formula - Calculate NPV CFI.

Add a Fraction Row which finds the percentage of remaining negative CCC as. Randis operating cash flow formula is represented by. Its important to understand exactly how the NPV formula works in Excel and the math behind itNPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future.

The total cost is provided and the time period during which this will happen. The cumulative cash flow is a term that can be used for projects or a company. To find the quarter for each monthly period simply use the following formula.

Select a blank cell adjacent to the Target column in this case select Cell C2 and type this formula SUM B2B2 and then drag the fill handle down to the cells you want to apply this formula. For example a company began operating three years ago. The discount rate has to correspond to the cash flow periods so an annual discount rate of r would apply to annual cash flows.

When all negative cash flows occur earlier in the sequence than all positive cash flows or when a projects sequence of cash flows contains only one negative cash flow IRR returns a unique value. If you need help get in contact. Add accumulative sum for chart in Excel with a handy feature Create an accumulative sum chart in Excel 1.

Time adjusted NPV formula. So for instance the quarter for month 5 will equal ROUNDUP 530 or 2. Calculate the Accumulated Cash Flow for each period.

How To Use The Excel Pv Function Exceljet

How To Use The Excel Xirr Function Exceljet

Manufacturing Kpi Dashboard Production Metrics In Excel Kpi Dashboard Excel Kpi Dashboard Kpi

How To Build A Cash Flow Forecast In Excel Tutorial Challengejp

10 Money Management Tools Inside Google Drive You Should Use Today Money Management Savings Calculator Retirement Savings Calculator

The Difference Between Annual Vs Monthly Npv In Excel Excelchat

Clothing Store Financial Model Excel For Business Etsy In 2021 Financial Plan Template Excel Templates Financial

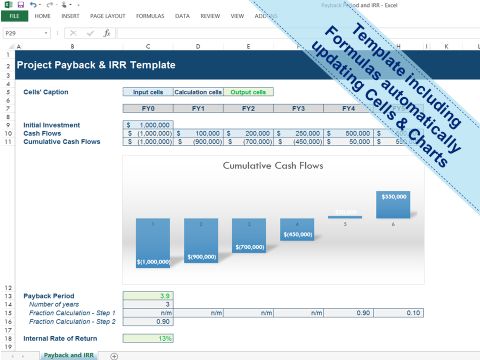

Payback Irr Consulting Business Management Change Management

Doing Cost Benefit Analysis In Excel A Case Study Excel Templates Case Study Excel

How To Use The Excel Fv Function Exceljet

Modeling Interest During Construction Idc Excel Project Finance Project Finance Excel Finance

How To Calculate Payback Period In Excel With Automated Updates

Calculate Npv In Excel Net Present Value Formula

How To Calculate The Payback Period With Excel

How To Calculate Payback Period In Excel Techtites

How To Calculate The Payback Period In Excel

How To Calculate The Payback Period With Excel

Excel Formula Bond Valuation Example Exceljet

All Microsoft Excel Templates Free To Download Free For Commercial Use Excel Templates Interest Calculator Credit Card Interest

Post a Comment for "Cumulative Cash Flow Formula Excel"