How Do You Calculate Cash Flow From Financing Activities

On the other hand if equity capital decreases over a period it implies share repurchase which is a cash. When calculating your businesss cash flow there are three different types of cash flow calculations youll want to run.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Explained

Add up any money received from the sale of assets paying back loans or the sale of stocks and bonds.

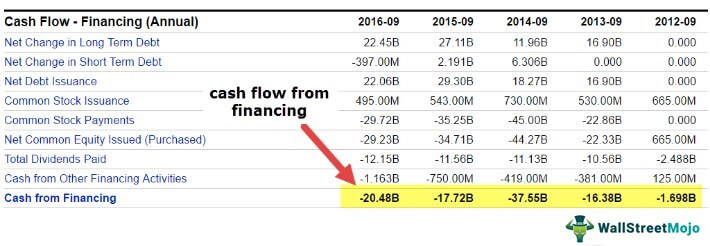

How do you calculate cash flow from financing activities. Cash flow from financing activities A cash flow statement displays operating investing and financing activities in three separate sections reporting the cumulative total at the end. Why Does Cash Flow from Financing Activities Matter. How do you calculate cash flow from operating activities.

You can obtain these reports online from the investor relations page of the companys website or from the US. How to Calculate Your Financial Cash Flow. CFF CED CD RP where.

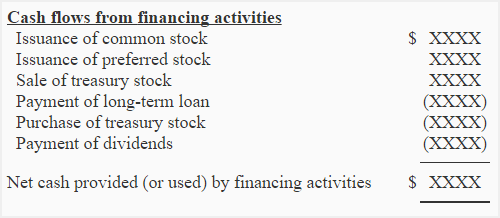

Looking for more details on Operating Cash Flow formula. CED Cash in flows from issuing equity or debt CD Cash paid as dividends RP Repurchase of debt and equity beginaligned textCFF CED -text CD RP. Cash from financing activities Disclosure of non-cash activities not always included Cash flow is calculated by taking the figures associated with each of the above activities and adding or subtracting them from your net income.

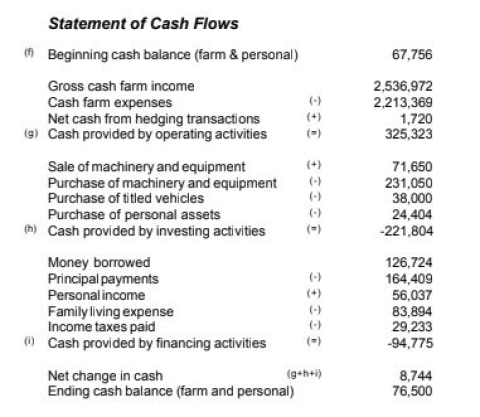

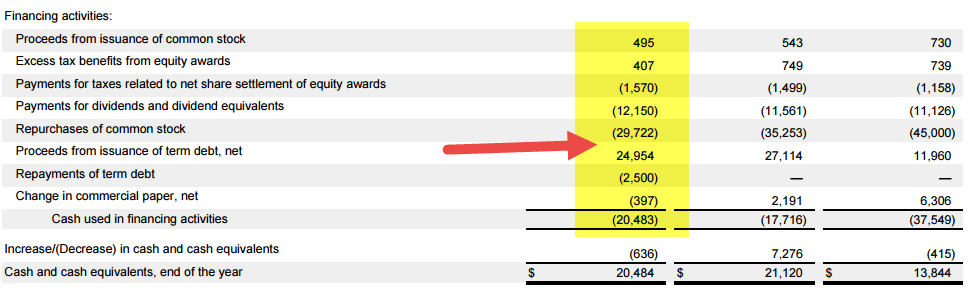

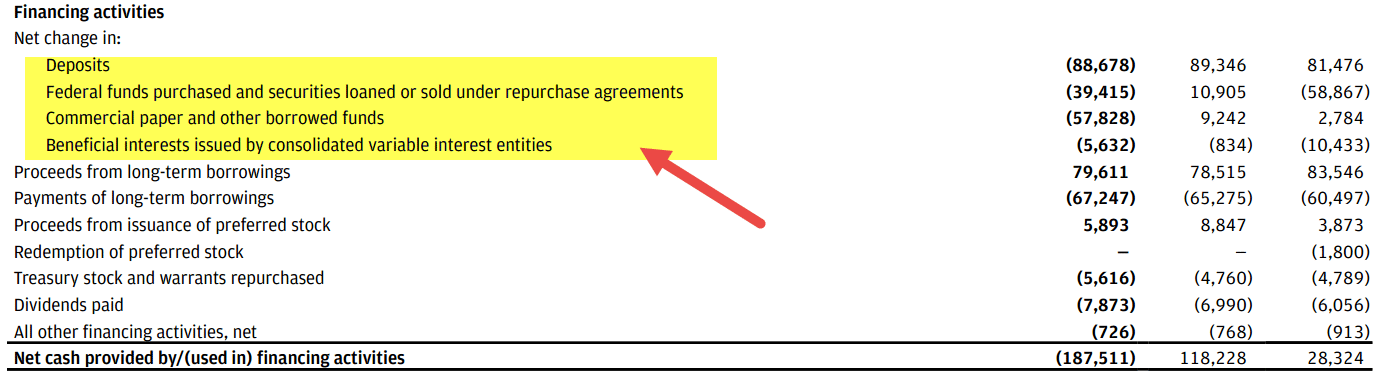

Investing activities include purchases of long-term assets such as property plant and equipment. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations formula that can be used. To calculate cash flow from financing activities all of the cash inflows and outflows associated with obtaining or repaying capital are summed.

Cash outflows from buying back equityshares. Cash Flow from Operations Formula. In this example the net cash flow from financing activities is 1600.

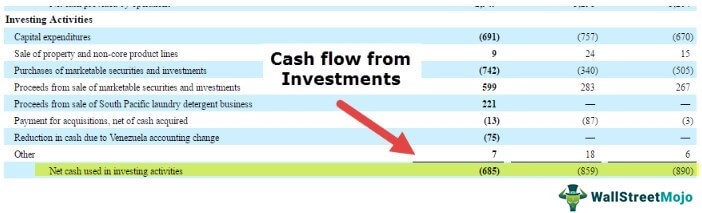

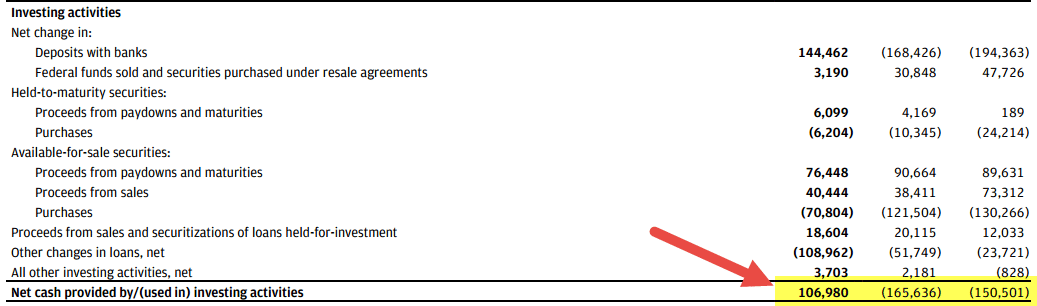

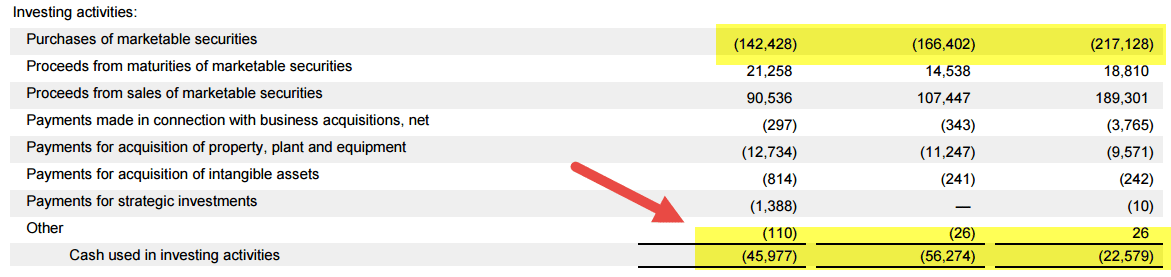

Cash Flow from Investing Activities is the section of a companys cash flow statement that displays how much money has been used in or generated from making investments during a specific time period. How to Calculate Cash Flow from Financing Activities. Subtract money paid out to buy assets make loans or buy stocks and bonds.

Examples of cash flows from financing activities include. This in turn allows you to estimate the future requirements to service this debt or provide returns to shareholders. Cash inflows from sale of equityshares.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. 85000 0 9000 -10000 66000 That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities. Cash inflows from raising loans mortgages and other borrowings.

Cash Flow from Financing Activities Formula 10000 20000 7000 17000. Find a public companys cash flow statement in either its 10-Q quarterly reports or in its 10-K annual reports. Now let us take an example of an organization and see how detailed cash flow from financing activities can help us in determining information about the company.

Calculating the cash flow from investing activities is simple. The operating cash flow formula is net income form the bottom of the income statement plus any non-cash items plus adjustments for changes in working capital is calculated by starting with net income which comes from the bottom of the income statement. Cash flow from financing activities is one of the three categories of cash flow statements.

If equity capital increases over a period it indicates additional issuance of shares which denotes cash inflow. Each one gives you different information about your cash flow including what you have available now for day-to-day operations what you can afford to reinvest back into the business and projected availability moving. The total is the figure you need.

Randis operating cash flow formula is represented by. Cash Flow from Operations Net Income Non-Cash Items Changes in Working Capital. Since the income statement uses accrual-based accounting.

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back. In order to calculate cash flow financing one needs first to identify the changes appearing in a companys balance sheet and differentiate cash outflows from cash inflows. Securities and Exchange Commissions EDGAR.

You can calculate net cash provided from financing activities to determine its reliance on outside funding for the period.

Negative Cash Flow Investments In Companies

Operating Cash Flow From Trading Activities Double Entry Bookkeeping

Cash Flow From Investing Activities Formula Calculations

Cash Flow From Investing Activities Formula Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow From Financing Activities Formula Calculations

I1 Wp Com Www Theancientbabylonians Com Wp Cont

Cash Flow Forecast For Start Up Business Plan Projections

Cash Flow From Investing Activities Formula Example Youtube

From The Following Information Calculate Cash Flow From Investing And Financing Activities Sarthaks Econnect Largest Online Education Community

How To Read A Cash Flow Statement And Understand Financial Statements

Cash Flow From Investing Activities Formula Calculations

Financing Activities Section Of Statement Of Cash Flows Accounting For Management

How To Calculate The Cash Flow From Investing Activities The Blueprint

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Example Calculation Youtube

Post a Comment for "How Do You Calculate Cash Flow From Financing Activities"