Cash Flow From Financing Activities Calculator

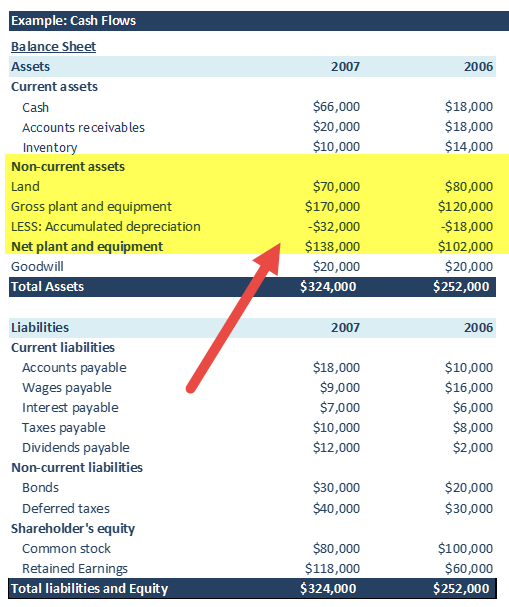

If equity capital increases over a period it indicates additional issuance of shares which denotes cash inflow. From the following Information calculate cash flow from investing and financing activities particulars 2010.

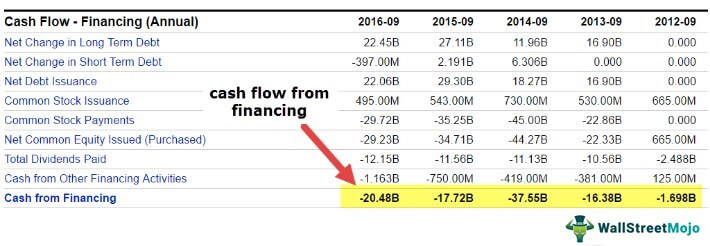

Cash Flow From Financing Activities Formula Calculations

For the sake of simplicity we will say Giant Company only has labor cost which is 30000.

Cash flow from financing activities calculator. It is not a part of financing activities. On the other hand if equity capital decreases over a. Calculate cash flow from financing activities.

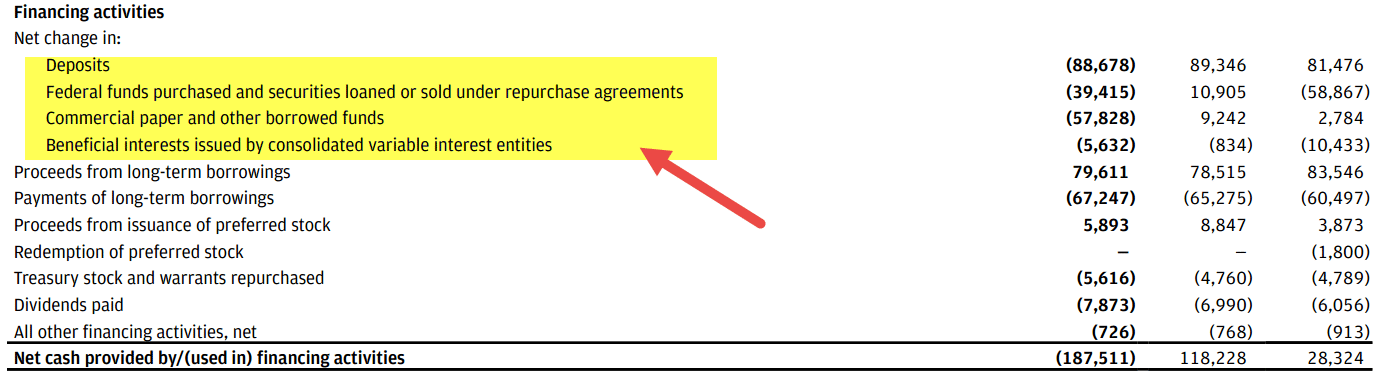

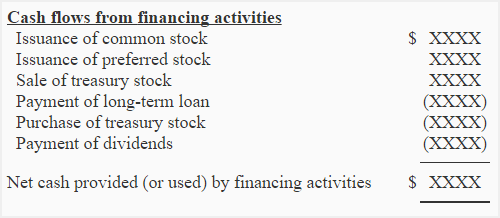

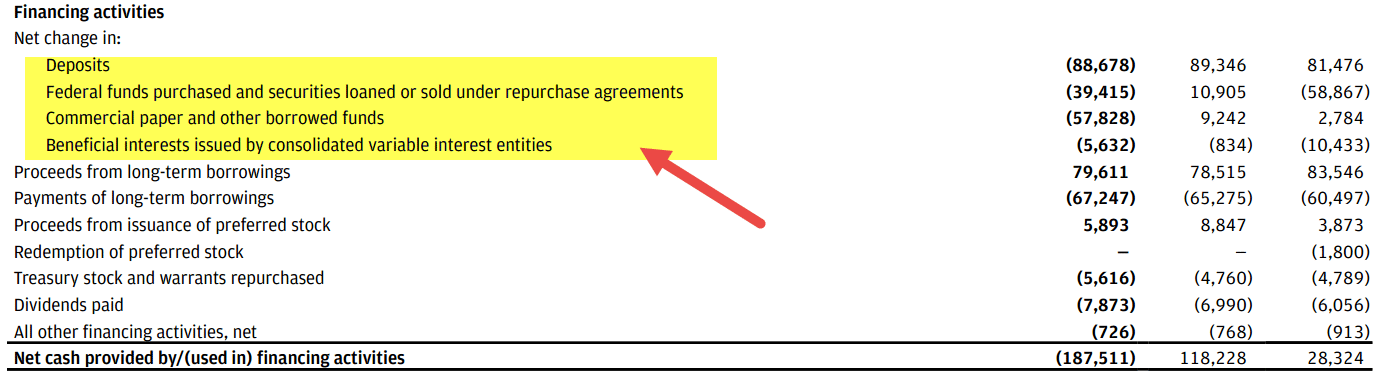

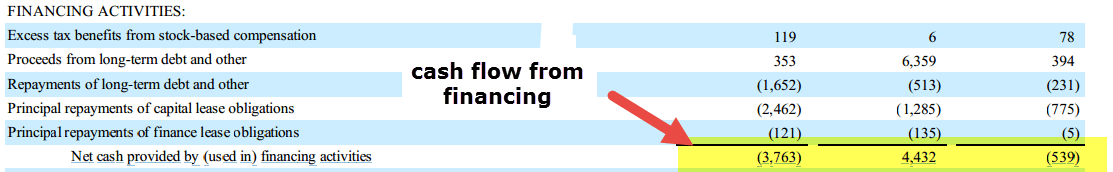

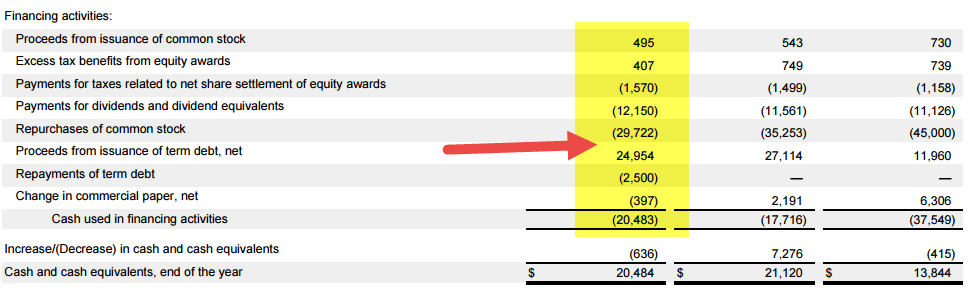

How to Calculate Cash Flow from Financing Activities. Cash flow from financing activities CFF measures the movement of cash between a firm and its owners investors and creditors. These activities are operating a.

In this video we are going to discuss Cash flow from Financing Activities in detail. In this example add 5000 and 1000 to get 6000 in total cash outflows. In order to calculate cash flow financing one needs first to identify the changes appearing in a companys balance sheet and differentiate cash outflows from cash inflows.

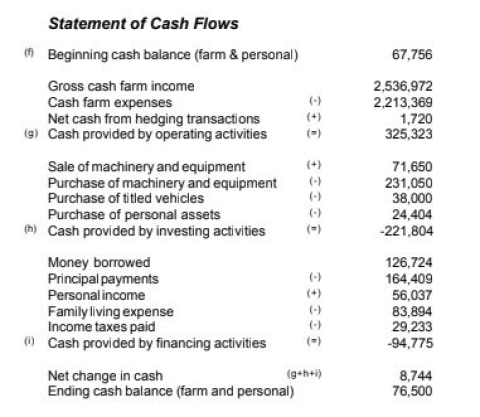

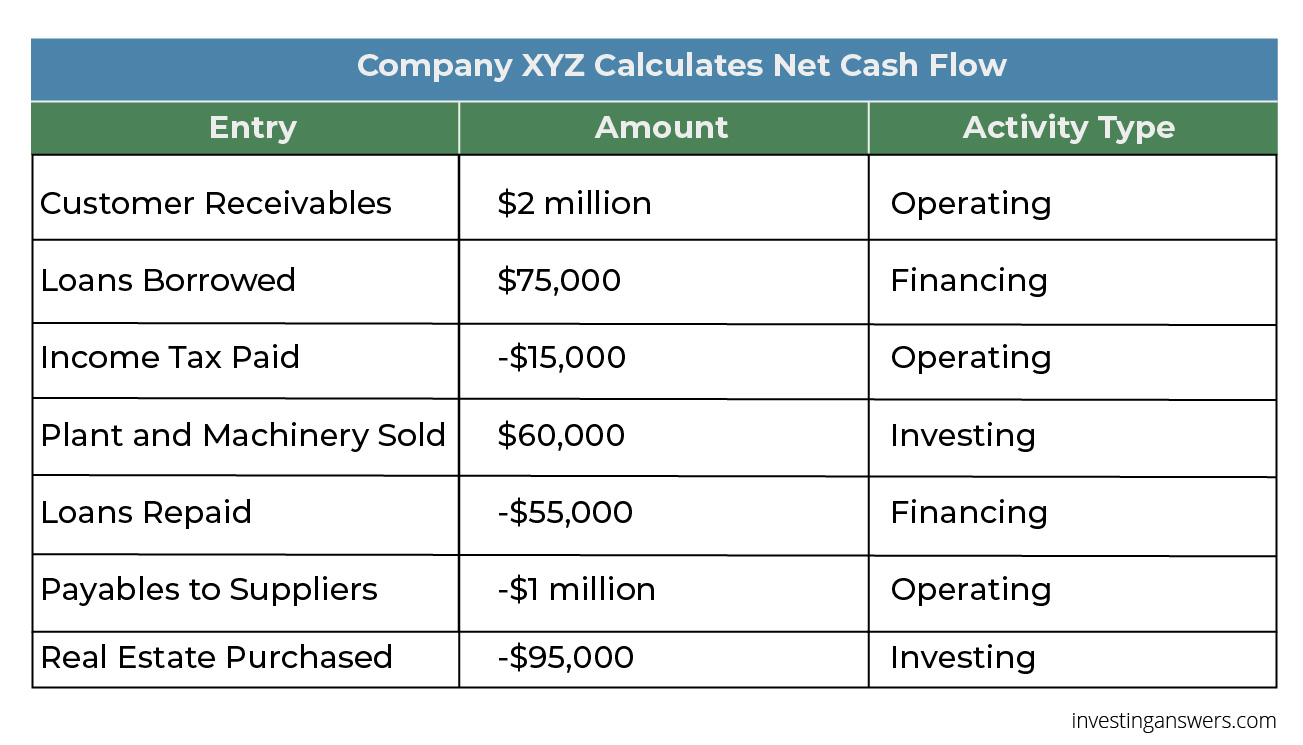

This is interpreted as. Subtract the total cash outflows from the total cash inflows in the financing activities section to calculate the net cash provided by financing activities. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance.

Investors earlier use to look into the income. The respective financing activities include transactions that involve dividends equity and debt. The free cash flow formula is.

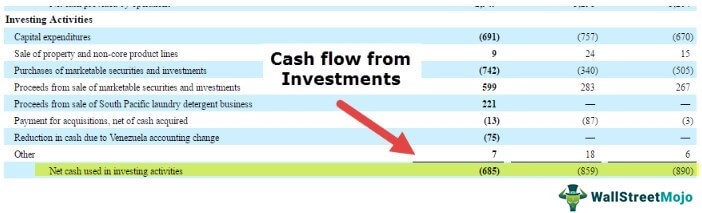

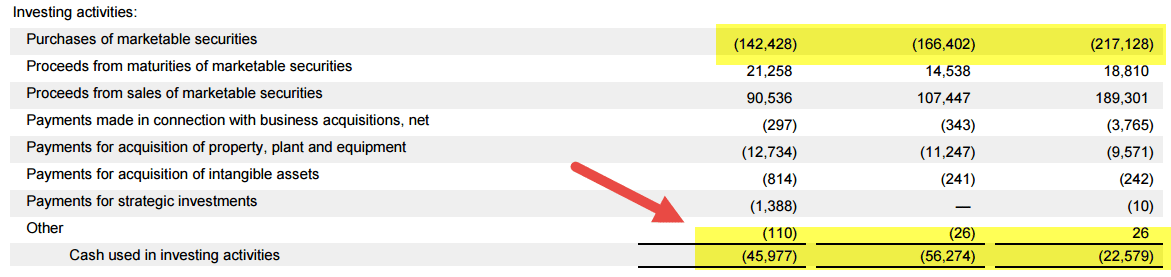

Investing activities includes cash flows from the sale of fixed asset purchase of a fixed asset sale and purchase of investment of business in shares or properties etc. Net Cash Flow Cash flows of a company are classified into three main heads or we can say as per three types of activities. How to Calculate Cash Flow Using a Cash Flow Statement.

Heres how this. Cash Flow Statement. Without that your business might not be able to meet vital obligations such as payroll accounts payable or loan payments.

It does not include issuing new stock or bonds for your company. Cash Flow from Financing Activities CFF Updated on August 13 2021 1861 views. Cash flow is calculated by taking the figures associated with each of the above activities and adding or subtracting them from your net income.

Cash received from the sale of any investments held. This source of income is included in the financing section of your cash flow statement. Follow this formula to calculate your small businesss cash flow.

Including some examples and calculation . Cash Flow from Financing Activities Cash Inflows from Equity or Debt Cash Paid as Dividends Repurchasing of Debt or Equity Put simply cash flow from financing activities looks at all cash coming in from issuing debt or equity and all cash going out from dividend payments and from buying back debt or. Loan Repaid 100000 New Loan Raised.

Cash flow from Financing Activities is represented in the cash flow statements revealing the net cash flows to be utilized towards funding the company. Cash flow from Investing Activities is the second of the three parts of the cash flow statement that shows the cash inflows and outflows from investing in an accounting year. This includes the sale of investments in other companies the sale of stock and the sale of bonds.

See your cash flow with our Cash Flow Calculator. Free cash flow Net income DepreciationAmortization Changes in Working Capital Capital Expenditure 3. Amount Amount Cash Flow from Financing Activities.

Cash Dividends Paid Dividends increase in dividends payable -17000 10000 -7000 Cash Flow from Financing Activities Formula 10000 20000 7000 17000. This report shows the net flow of funds used to run the company. Net Income - Operating Activities - Investing Activities - Financing Activities Beginning Cash Balance Ending Cash Balance.

2011 amounted to Rs. Then add the result to your beginning cash balance. Add or subtract all the cash from operating activities investing activities and financing activities.

Calculate the sum of these payments to determine the total cash outflows in the financing activities section. 100000 10000 -30000 110000 - 30000 80000 operating cash flows 2. An essential part of keeping a business running is adequate cash flow.

Financing Activities Section Of Statement Of Cash Flows Accounting For Management

Guide How To Calculate Net Cash Flow In 4 Easy Steps Actioncoach

How To Calculate The Cash Flow From Investing Activities The Blueprint

Cash Flow From Investing Activities Formula Calculations

Cash Flow From Investing Activities Formula Example Youtube

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow From Financing Activities Formula Example Calculation Youtube

Cash Flow From Financing Activities Formula Calculations

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow From Investing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Investing Activities Overview Example What S Included

Cash Flow From Investing Activities Formula Calculations

Net Cash Flow Formula Definition Investinganswers

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Double Entry Bookkeeping

Net Cash Flow Formula Calculator Examples With Excel Template

Post a Comment for "Cash Flow From Financing Activities Calculator"