Cash Flow Banking Pros And Cons

In conclusion a company should weigh the pros and cons prior to making any decision. The type of cash flow method used by a bank is usually determined by a written credit policy or the credit culture prevalent in the institution.

![]()

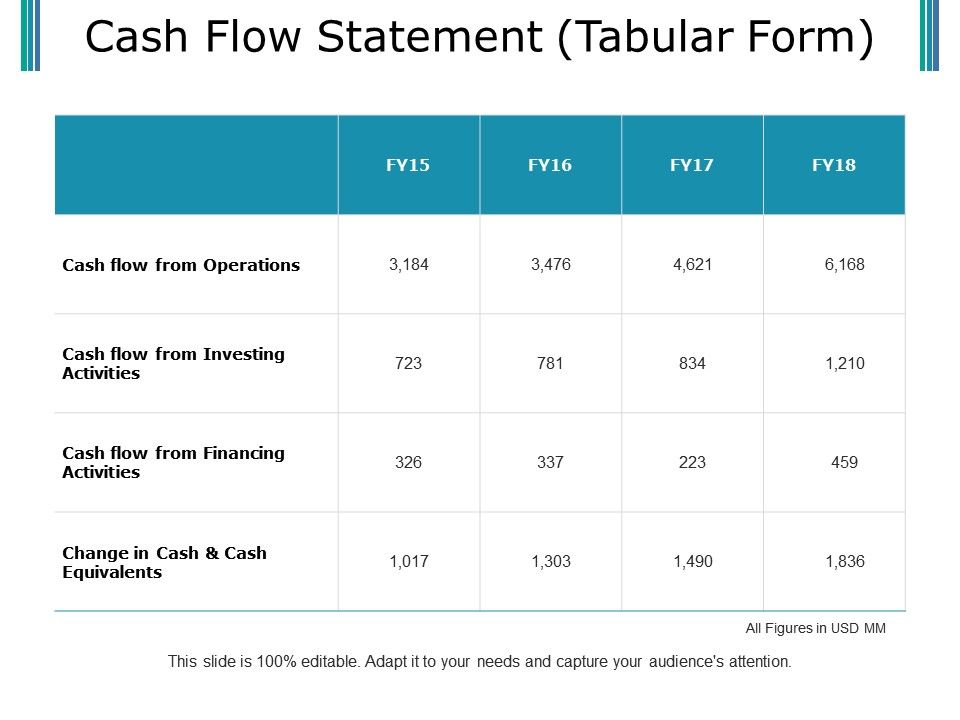

Cash Flow Statement Fy 2020 2021 Ppt Powerpoint Presentation Icon Example Presentation Graphics Presentation Powerpoint Example Slide Templates

Getting out of debt can really liberate you and create a new level of peace and happiness in your life.

Cash flow banking pros and cons. Imagine if you were to pay in cash every few years to buy a new car or make real estate investments. Pros of Private Mortgage Insurance Private mortgage insurance can be appealing for prospective buyers because it allows them to purchase property sooner. The pros and cons of a cash flow forecast show that this information is useful when it becomes one of many tools used to look at the financial health of an organization.

Ive tried to utilize the infinite banking concept with other financial assets but the unique characteristics needed to utilize this concept just arent afforded in other assets. The pros and cons of free cash flow show that for short-term investments it can be used to achieve better profits. When these business owners are in need of more cash flow they are the least likely to be approved.

Its easy to understand. The two major financing options available to them for this purpose are bank loans and private financing. Cash basis accounting tends to be simpler to understand than other accounting methods.

It seems that many banks use one of these two methods. Pros of the cash method. Reduced stress often means better long-term health and you may even find a positive impact in your personal relationships as you have a newfound confidence.

You could compromise your cash flow. If it becomes the only statement that the leadership team reviews for decision-making purposes then there could be money issues in the future that might cause some worry. One of the biggest pros to the infinite banking concept is that your compounding goes uninterrupted.

Pros of the cash method include. When you want to secure financing for your business one or more banks may be at the top of your lender consideration list. Take real estate for example if I were to try to use a real estate property for the IBC strategy the below are the pros and cons.

The cash method is a more immediate recognition of revenue and expenses while the accrual method focuses on anticipated revenue and expenses. Q1 - What are the pros and cons for using the UCA cash flow method versus EBITDA. There are many types of business loans from these financing providers.

Rather than waiting until you can afford 20 percent down you dont have to miss out on your dream home. As part of your due diligence in comparing the lending options available to you from banks and other sources its good to keep in mind the pros and cons of securing a business loan with a bank. It may just be one method of examining a stock but the accuracy of this method means it.

This section will provide a brief overview of some of the advantages and disadvantages of infinite banking. In the case of my current employer both UCA cash flow and. At Cash Flow Resources we.

This method is all about focusing on cash flow more effectively. But in order to help you better understand which options best suits your needs lets tackle the pros and cons of each. Invoice factoring is not for every small business but it can be a great solution for many that need working capital to solve their cash flow needs.

I recommend having at least 50 of cash flow. Some financial experts consider MCAs to be predatory because they can set you up for whats known as a borrowing cycle or trap. It is more accurate eliminates guesswork and is a tangible bit of information that only requires assumptions on longer-term investments.

Velocity banking requires extra money Cash Flow this is what we use to pay off parts of our outstanding balance. If you arent able to qualify for conventional loans or other less-expensive forms of financing the costs of MCA advances can compromise your cash flow. Requires free cash flow.

The pros and cons of alternative financing Small and medium-sized businesses have historically had challenging relationships with traditional lenders.

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Financial Statement Analysis Personal Financial Statement

Cash Flow Banking With Whole Life Insurance Explained

/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

Discounted Cash Flows Vs Comparables

/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

Discounted Cash Flows Vs Comparables

How To Open A Current Account Online Accounting Online Accounting Current

Cash Flow Statement Mymoneysouq Financial Blog

The 79 Best Alternative Investment Ideas For Returns And Diversification Investing Cash Flow Investing Money

Cash Flow Statement Example Of Ppt Presentation Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Ebitda Vs Cash Flow From Operations Vs Free Cash Flow Wall Street Prep

Cash Accounting Management Guru Cash Flow Cash Accounting Small Business Advice

Discounted Cash Flow Analysis Street Of Walls

Infinite Banking Concept Pros And Cons Should You Be Your Own Bank Youtube Infinite Banking How To Get Rich Millionaire Mindset

Discounted Cash Flow Analysis Street Of Walls

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

Discounted Cash Flow Analysis Street Of Walls

Consignment Money Management Activities Accounting And Finance Money Management

Post a Comment for "Cash Flow Banking Pros And Cons"